Change is the only constant, but sometimes a lot can change in a very short span and the last three months have transformed our world in ways than no one could have anticipated as we rang in 2020 with much hope and optimism. The past few years have been tough for the Retail industry across the world, but particularly in the US, and consequently for their landlords. Precipitated in parts by overcapacity due to aggressive growth in the number of stores, the failure to adapt to every changing customer preferences and demographics and the ever increasing market share of e-commerce, tens of thousands of stores have gone out of business and dozens of malls have gone dark in the recent past. What’s been referred to as the Retail Apocalypse, albeit in highly exaggerated fashion, has only been played up even more in recent weeks as the vast majority of non-essential retail and almost every shopping mall across the world has been shuttered by Government fiat.

Let’s be honest here, there’s no disputing the very unfortunate fact that a significant proportion of retail tenants will likely never open doors again due to cash flow issues arising from the abrupt and total loss of revenues for six to eight weeks (or more), and that more will be forced out of business over the next 12-24 months due to reduced consumer demand in a recessionary environment.

That said, the fundamental story of consumer consumption is unlikely to change all that much and there will be many categories where physical consumption is either necessary or strongly preferred to e-commerce. Indeed, there are already some green shoots as malls across the world reopen post this cataclysmic shutdown, with Simon reporting encouraging sales figures at its recently re-opened centers as well as the phenomenon of “revenge shopping”, both of which point to a measure of pent-up demand for physical retail.

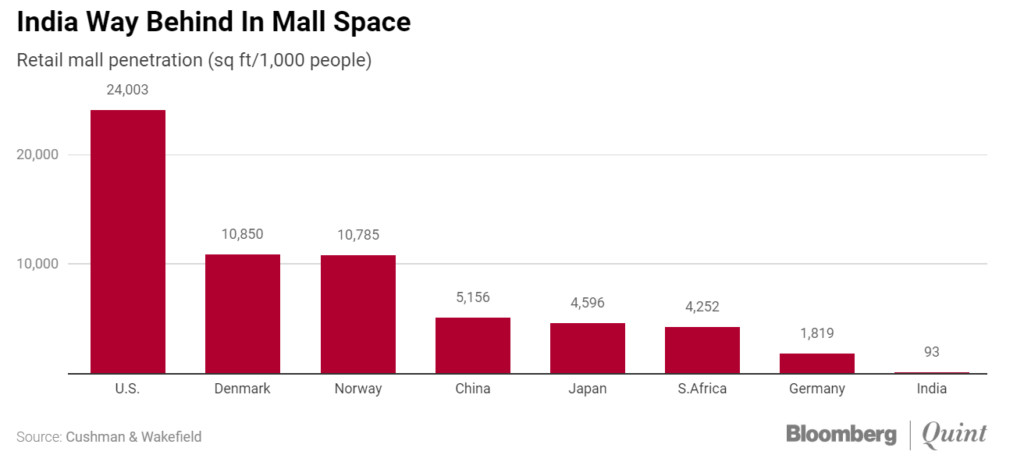

The strength of the attraction to physical retail is especially likely to be evident in rapidly growing markets like India where a combination of a burgeoning population of young consumers and the gross under penetration of modern retail – a.k.a the shopping mall/center – will continue to create strong demand for high-quality retail offerings. Another factor that needs to be borne in mind, as pointed out by some of my fellow panellists from across the globe at a recent Retail eSummit organized by GRI, is the crucial role played by shopping centers/precincts as safe, secure, comfortable public spaces, especially in countries like India where dense cities usually lack open spaces that people can safely congregate in without being exposed to inclement weather, pollution and crime.

Equally evident is the fact even in India the Retail industry – both stores and landlords – will have to quickly adapt in order to survive. There will be painful contraction and consolidation in the industry over the next 12-24 months but the underlying demand is much stronger and more likely to grow in India than any other large economy in the world over the medium and long term. This is why some of the world’s largest investors have taken significant positions in retail real estate investment platforms in India over the last 3-4 years. Assuming that the long term confidence in the market remains unshaken, it certainly bears examination what sorts of changes may be coming.

Much has already been made of the trend of Experiential Retail, how dining, entertainment, and lifestyle options are increasing their footprint within malls and shopping centers, at the expense of traditional retails, edging out categories like electronics and apparel. Big box department stores are being swapped out for multiplexes, gyms, restaurants and trendy food halls. The logic is simple, it’s tough to eat a Michelin-starred meal over Zoom or truly take in the amazing cinematic experience of IMAX even on a room-filling 72″ OLED screen at home. Other concepts that merge the online and offline channels include click-and-pick up outlets, now being embraced by formerly online-only brands including Amazon as much as offline giants like IKEA. Referred to as Omnichannel retailing, this has been further underpinned by the fact that a brand’s offline presence in a market has been found to reinforce its online presence in the same catchment.

Articles abound on this shift to Experential and Omnichannel retailing and the world’s largest retail landlords, like Unibail Rodamco Westfield are embracing it with gusto. A third trend that is being pursued both those striving to take retail into a bright future and those looking to profit from the bleached bones of failed or failing shopping centers is to go from stand-alone retail uses to Mixed Use development, betting that bringing other uses like Offices, Residential, Hospitality and even Logistics in close proximity to Retail creates a win-win outcome.

But to ensure its survival and growth over the coming years and decades, the Retail industry has to look at even more transformative and strategic concepts, where it becomes not just a purveyor of Experiences to shoppers but also an Audience provider to its tenants as well as integrated digital solutions to act as a disintermediator of and to enhance the flexibility of its bricks and mortar asset base.

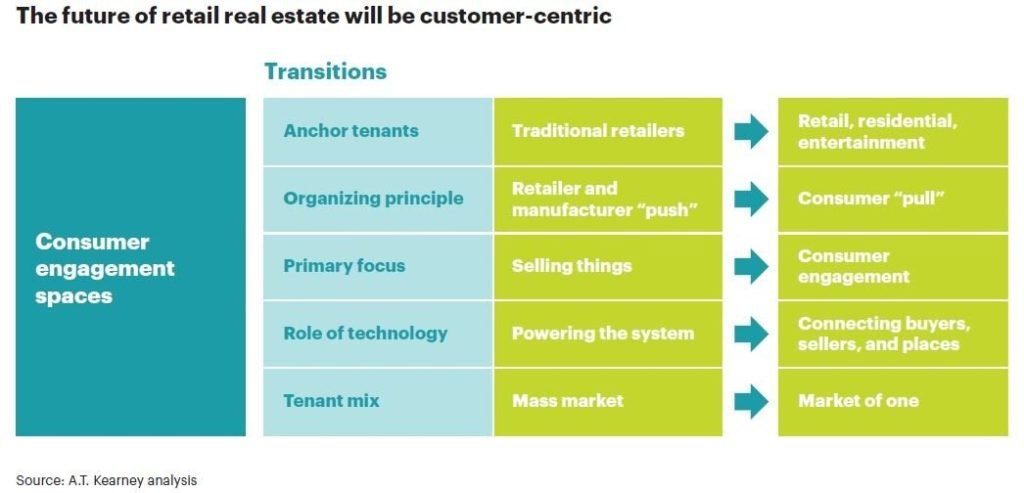

AT Kearney has espoused extensively on the future of shopping centers in recent times, redefining malls as Consumer Engagement Spaces (CES), and focusing on four typologies of Retail in the future. The concept of the CES is quite fascinating, where the shopping mall becomes the centrepiece of a mixed-use commercial development designed to meet the needs of existing and new categories of customers. The key change is in envisioning all retail, and not just entertainment and dining, as experiences for the customer, going beyond just the physical products on offer.

The onus is on retailers to convert their offerings into experience-centric, omnichannel ones but the landlords will have to play an important role as well, both in terms of skewing the tenant mix towards experiential uses in order to get the audience in the door, so as to speak, and in providing infrastructure, mostly in the digital realm, for the tenants to implement experiential retailing. Newer centers in India, including our own 1.4 Million square foot Zentrum, Trivandrum, already have experience-centric tenant mixes, with up to 40% of the space allotted to entertainment, food and beverage and experiential amenities like gyms, spas, daycares and others.

The next step is to enhance the experience of shoppers through digital means by creating an integrated Retail Operating System that can bring all sorts of facilities to the fingertips – the smartphones – of the shoppers, such as indoor navigation, parking, payments, reservations, loyalty programs and concierge services. All these would be delivered in the physical realm of the mall but via a dedicated app and website, as well as through touchscreens located with the mall. In a sense, this is again an extension of omnichannel retailing, combing clicks and mortar in a seamless way to extend what the physical asset can do. For example, whereas malls used to depend on well thought out and executed signags and malls (interactive and static) to help shoppers navigate their often labyrinthine interiors, bringing in the interactive and more accurate ease of mapping services on the smart devices, something that most of us need to even make it to the shop on the other side of the street from us, makes the exploration of retail spaces less effort-intensive and ensures that shoppers can know every single store in the mall, where there are often hundreds of brands in what can be a bewildering array of options. Shoppers can often navigate directly to the brands’ websites and apps, look up what products are available in the stores in the mall and receive offers, even as they walk to the store itself. There’s an array of technology ranging from Bluetooth beacons to Wi-fi based navigation that’s already available, and landlords may only ignore these at their extreme peril.

Digital technology can help Disintermediate the relationship between the bricks-and-mortar and the shoppers in a very positive manner. Whereas it’s often very difficult, expensive and time-consuming to make significant changes to the physical nature of the asset itself, the digital experience can be modified quickly, and often in real-time. Consider a post-pandemic scenario where the shopper has been made acutely aware of the need for frequent visits to the washroom and the hand sanitizing station. It would be very difficult for a mall to tack on additional washbasins at short notice, if at all without major modifications to its structure and systems, and while it would be less challenging to blanket the space with more sanitizer dispensers, it would make the facility management team’s job much tougher. A digital solution would to not only highlight the locations of washrooms and dispensing stations on the mall’s indoor navigation map but could also give status reports of which washrooms are seeing heavy traffic and which ones less so, perhaps in traffic light format. The consequence is that the average shopper perceives a greater availability of hygiene options and therefore feels that the mall is a safer place to visit, all without knocking walls down. Just as only the chameleon’s skin changes colors to enable its brilliant camouflage capabilities while its flesh and bones stay the same, the digital envelope will allow the mall to keep adapting better and faster without changing the physical asset itself. Digital systems also help to reach out to shoppers with special messaging during exigencies and to identify and help communicate with the mall’s most loyal customers, via a dedicated loyalty management system.

The role of the landlord will have to transform from being a provider of space to a provider of the market for retailers to operate in – it’s not just about the physical space and its qualities, but about the ability to channel an actionable audience to the tenants so that they can see meaningful sales. The traditional means to ensure this have been through well-thought out design of the spaces, including horizontal and vertical circulation patterns and store placements, as well as by creatung the sort of tenant mix that attracts shoppers to the mall. For example, we hired the world’s leading retail architects Benoy for Zentrum and they spent months refining the design to ensure that shoppers get to every corner of the expansive floors and properly “irrigate the scheme”, as one of our lead architects loves to call it. However, once the design has been finalized and built, it’s more or less cast in..well.. concrete and there’s not much the landlord can do to enhance circulation other than switch a few tenants around once every few years. That’s fast changing today, there are many technology providers that have sophisticated digital solutions that enable landlords to understand precise shopper movement and behavior patterns. Using a combination of technologies like cameras, Bluetooth and Wi-fi, their systems can help landlords take steps to enhance and optimize the shopper flow on the one hand, create decision supporting information that can be shared with tenants and also put in place metrics to judge how tenants are performing, for example how well they’re able to attract shoppers who walk past their storefronts and then convert walk-ins to sales. Imagine having that sort of information at your fingertips as a landlord when the next rent renegotiation comes up.

Other paradigms seeing widespread acceptance across the world and beginning to make their mark in India include retail-centric, mixed-use development and incorporating Wellness concepts into the design of retail centers. Mixed-use calls for incorporating office, residential and hospitality uses around a core of retail, and leverages the popular trend of the “Work-Live-Shop-Play” lifestyle which enables urban dwellers to access all the activity elements that they need or desire within a small, often walking radius. Additionally, elements of the mixed use development support each other – the office workers eat lunch at and shop in the retail, the residents work in the office, and so on. Recent developments such Blackstone/Nexus’ Elante in Chandigarh and a number of the Phoenix Market City locations across India incorporate mixed-use. Taurus’ Zentrum is surrounded by 380,000 square feet of offices, 232 hotel keys and 301 residences, together creating a 2.8 Million square foot, dense, fine grained, mixed-use development. It’s quite likely that upcoming and future developments from the many retail investment and development platforms in India will follow this paradigm, going from stand-alone retail concepts to precincts that incorporate a mix of uses, centered around a sizeable retail, entertainment and dining center.

COVID has thrown Wellness sharply into focus as a personal safety concern, although the concept of Wellness goes far beyond that and encompasses areas like overall health and productivity, as defined by the globally accepted WELL standard. As a landlord, it becomes critical that our spaces are accepted by shoppers as being safe and secure for themselves and their families and friends. In the short and medium term, as the memories of the disruption and tragedy of COVID remains fresh, this will be particularly critical in welcoming shoppers back to malls. Strategies that retail landlords need to consider, beyond installing extra sanitizing stations and thermal scanners, include well-understood measures such as enhancing air filtration (with MERV, HEPA and UV-C systems) as well as new and innovative ones such as deployment of robotic UV-C systems to sanitize common areas during off-times. In the short run this means additional capital expenditure for landlords and higher maintenance charges for tenants over the longer term, but it’s certain that no one will want to be caught out in skimping on such measures.

Overall, it’s evident that retail landlords need to think beyond mitigation measures to surmount the current crisis and plan for longer term and more strategic changes in the way that they do business such that the fundamental nature of their assets and offerings can be optimized to meet the changing needs of a rapidly evolving market. The retail market in India offers great promise, perhaps more than anywhere else, because of the sheer size of the audience as well as the relative paucity of high-quality assets in the market as of now. Yet, landlords should not delay in bringing the state-of-the-art from across the world to India so that they can take advantage of the long and sustained recovery, and ensure that the industry is better off post the pandemic than before.

Author: Ajay Prasad, Country Managing Director, Taurus India

Original post: https://www.linkedin.com/pulse/retail-post-pandemic-ajay-prasad/?trackingId=1ESLYpTbJs9qbi00PdQutw%3D%3D